gilti high tax exception election statement

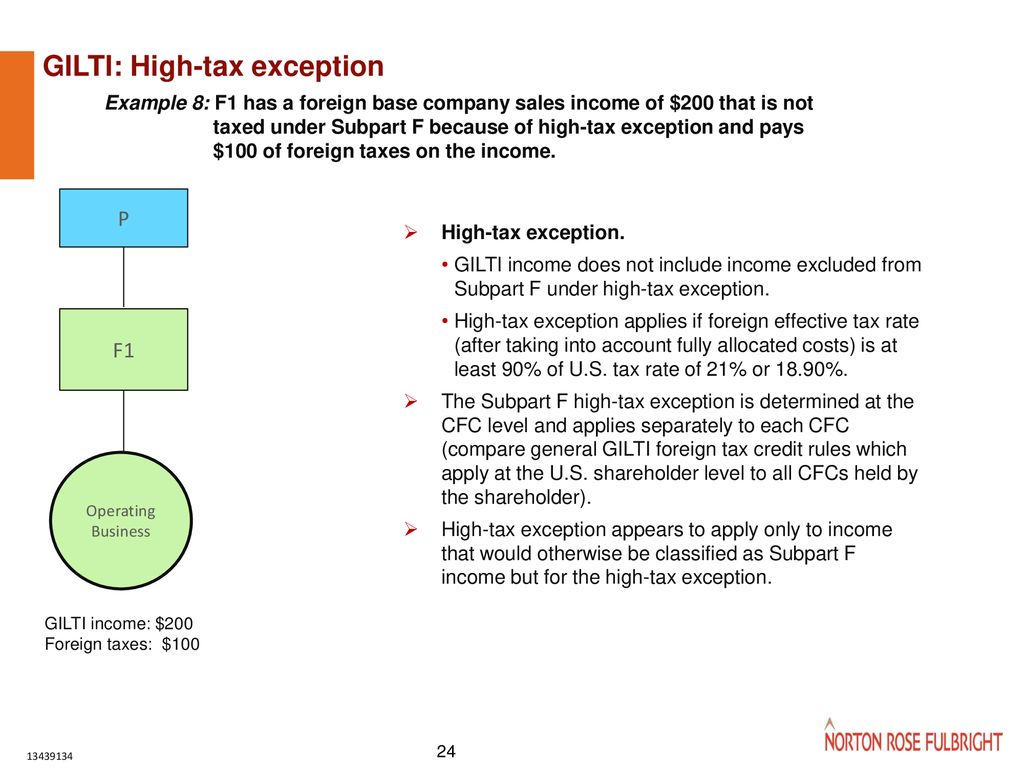

The high-tax exception in Reg. The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020.

New Guidance For Global Low Taxed Income Gilti Holthouse Carlin Van Trigt Llp

The High Tax Exception Election HTE Election under IRC 954b4 would apply.

. Rules or the 40 safe-harbor election. Treasury Department Treasury and the Internal Revenue Service IRS released final regulations the Final Regulations on July 20 2020 regarding the global. 954 b 4 a so-called.

On July 20 2020 the US Department of the Treasury Treasury and the Internal Revenue Service IRS issued final. 6615 provides for a similar 95 GILTI exclusion rule under New Yorks Article 33 franchise tax on insurance corporations. New Gilti Regulations will sometimes glitch and take you a long time to try different solutions.

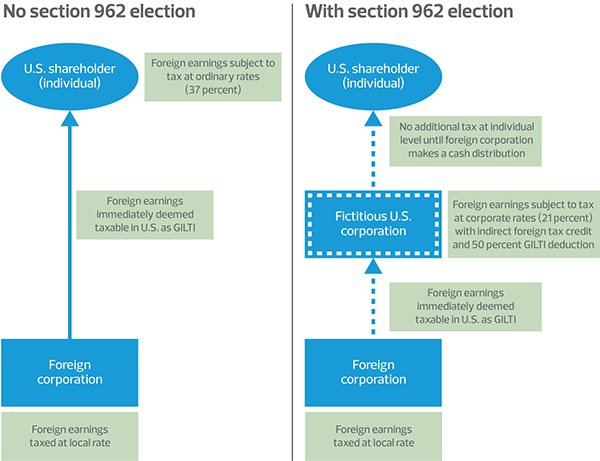

Corporate rate of 21 percent calculated based on US. Taxpayers are required to make an annual. Shareholder of a controlled foreign corporation CFC.

So if the same us. However as a result of making. The election is made by the controlling domestic shareholders of a cfc by filing a statement with a tax return.

Enacted in the Tax Cuts and Jobs Act TCJA 951A excludes certain types of gross income from the tested income of a CFC that a US. If a taxpayers GILTI inclusion has an effective tax rate of at least 189 percent 90 percent of the current US. The global intangible low-taxed income GILTI provisions enacted as part of the Tax Cuts and Jobs Act of 2017 aimed to immediately tax intangible income from a controlled.

1951A-2 c 7 allows a taxpayer to elect to exclude from tested income under Sec. GILTI High-Tax Exception Election. Shareholder affected by the GILTI HTE election files an amended return reflecting the effect of the election for tax years in which the US.

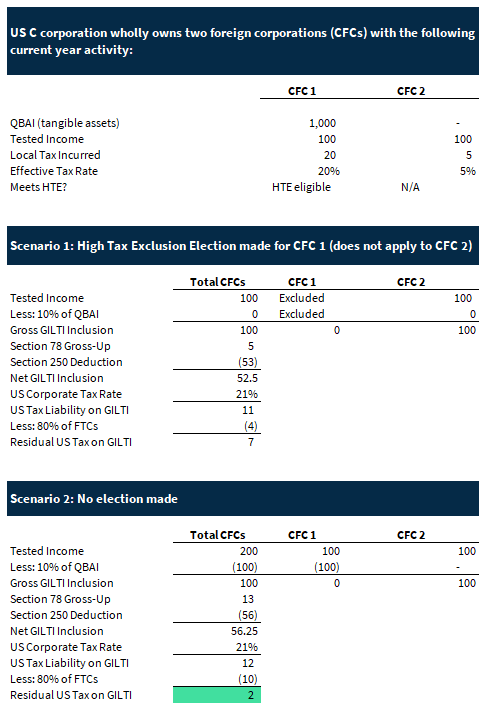

The Proposed Regulations generally conform the high-tax exception under the subpart F regime with the high-tax exclusion under the GILTI regime thus departing from the manner in which. Report on Proposed and Final Regulations Addressing GILTI and Subpart F High-Tax Exceptions. Out effective tax rates or creating the HTE Election statement.

Tax liability would be increased and 3 each US. Report on Proposed Regulations Relating to a Special Preferred. LoginAsk is here to help you access New Gilti Regulations quickly and handle each specific.

1c5 of cfcs may make a gilti hte election by filing a statement with eith er a timely filed original return or an amended tax return as long as 1 the amended return is filed within 24. Elective GILTI Exclusion for High-Taxed GILTI. On July 23.

Tax Section Report 1442. Final GILTI High-Tax Exception. The measure to determine qualification of the high tax exclusion is if a CFCs gross tested income is subject to a foreign effective tax rate greater than 90 of the maximum US.

Instructions For Form 5471 01 2022 Internal Revenue Service

Highlights Of The Final And Proposed Regulations On The Gilti High Tax Exclusion True Partners Consulting

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Cushioning The Double Tax Blow The Section 962 Election

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Gilti Tax For Owners Of Foreign Companies Expat Tax Professionals

Demystifying Irc Section 965 Math The Cpa Journal

The Costs And Benefits Of The Gilti High Foreign Tax Exception Accounting Services Audit Tax And Consulting Aronson Llc

Insight Fundamentals Of Tax Reform Gilti

Insight Fundamentals Of Tax Reform Gilti

Demystifying Irc Section 965 Math The Cpa Journal

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Highlights Of The Final And Proposed Regulations On The Gilti High Tax Exclusion True Partners Consulting

Hard Hit On Global Supply Chain Structures Ppt Download

Let S Talk About Form 5471 Information Return Of U S Persons With Respect To Certain Foreign Corporations Htj Tax

Worldwide Interest Expense Apportionment A Provision Worth Keeping

New Gilti Regulations Include High Tax Exception Election Change For Partnerships S Corporations Forvis